Dormant Company (Sleeping or Shelf company) in Thailand

How we serve Accounting, Auditing and Tax Services for a dormant company in Thailand (Shelf company in Thailand).

Fee : Baht 15,000 per year,covers the below:

(Our fee, excluding tax amount, actual cost for step of AGM).

(Our fee may be changed during April to May)

Scopes of service for - Dormant company; a company without business activity.

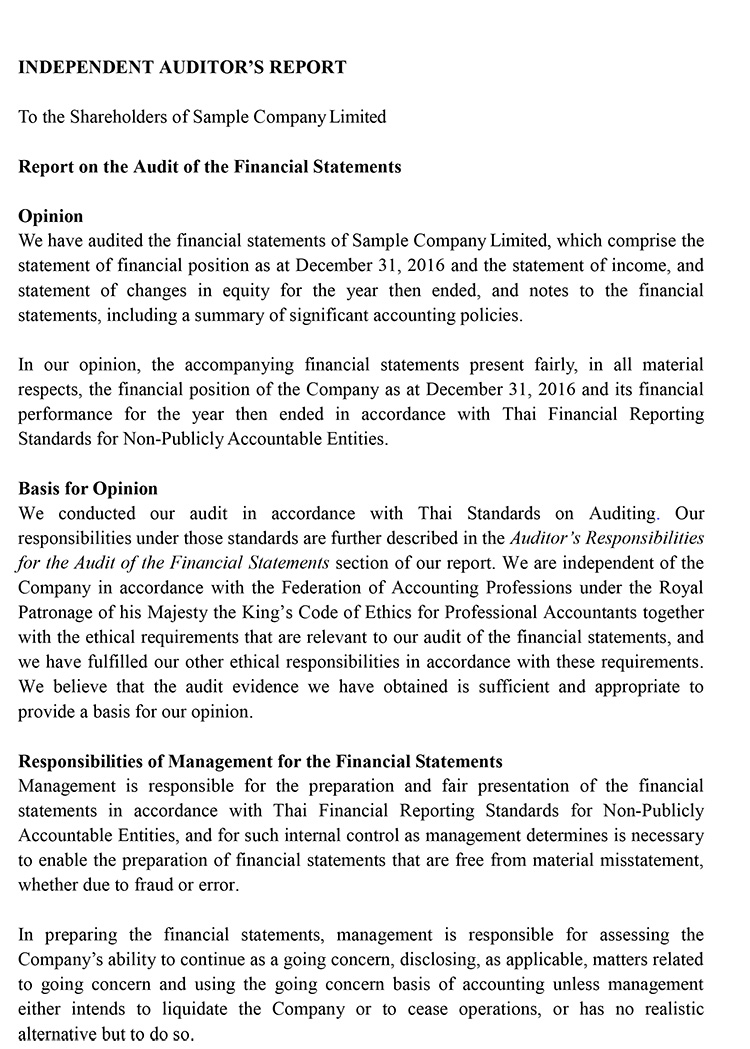

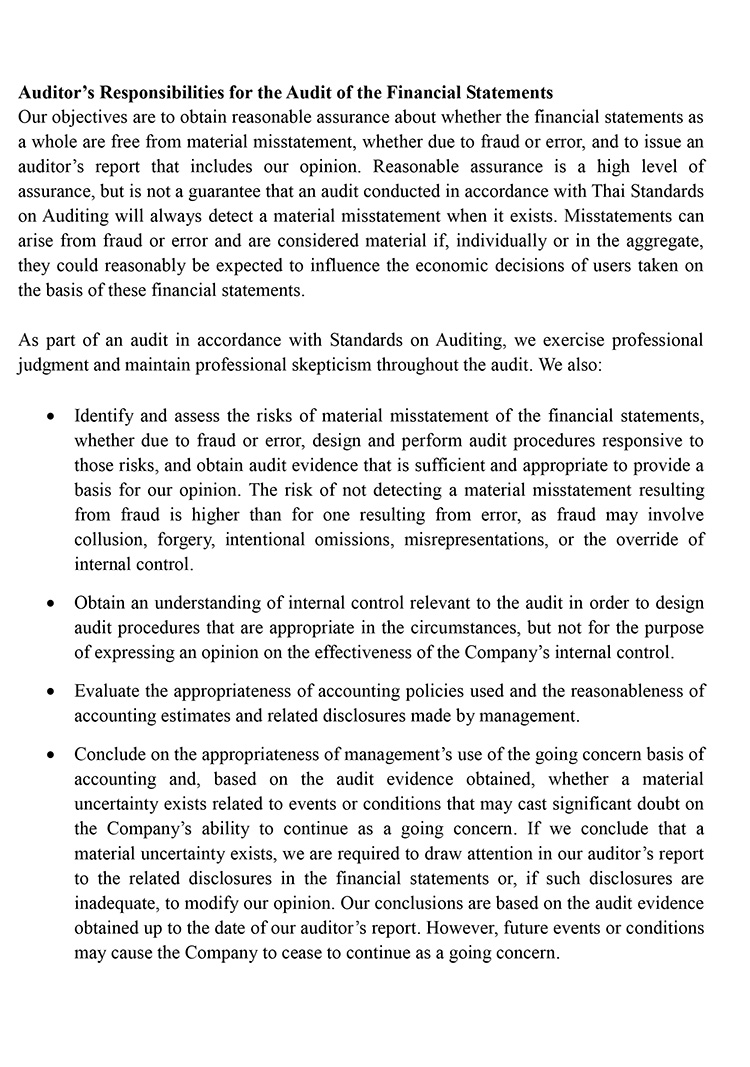

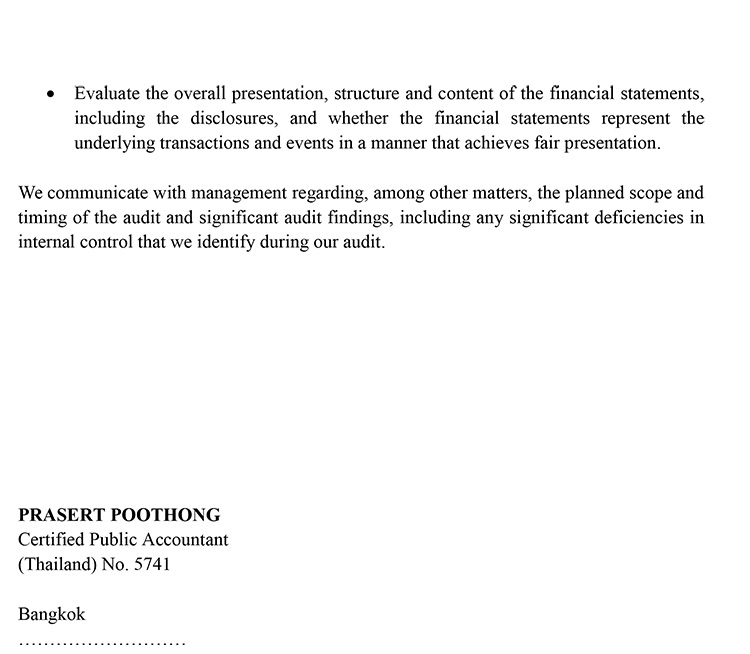

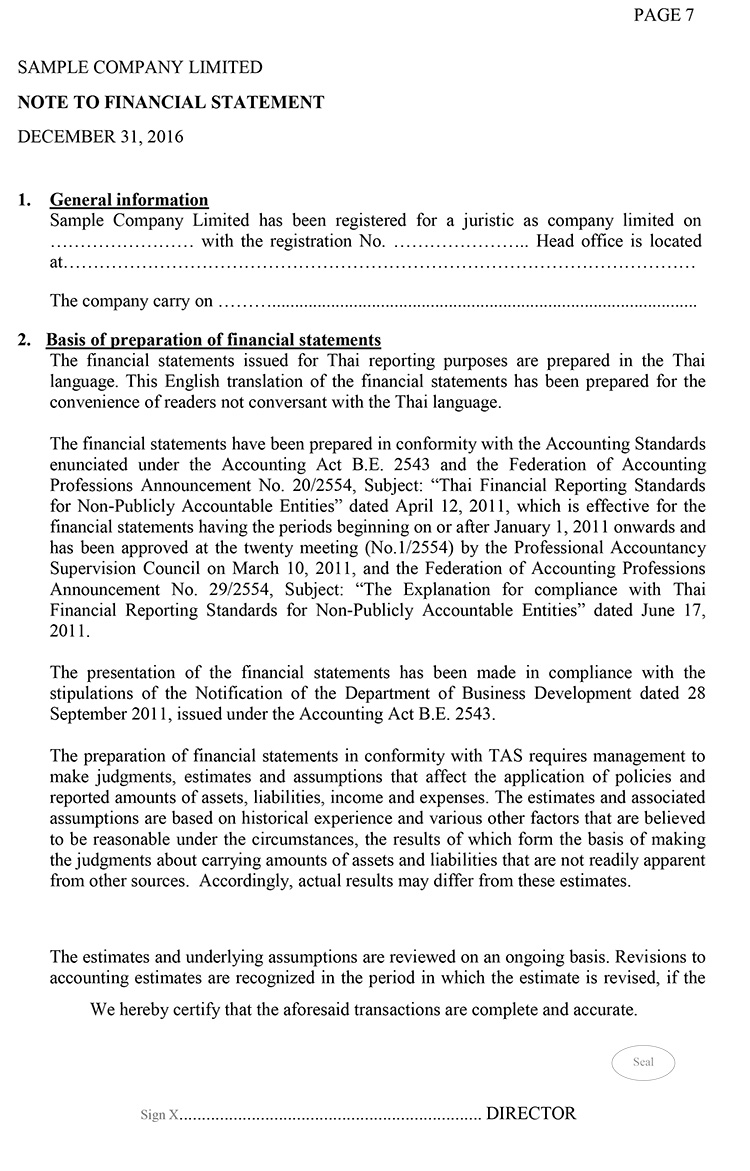

- Preparation of Yearly Audit Financial Statement with certified and audited by Certified Public Accountant (CPA, Thailand) and issue auditor's report in English version.

- Preparation for accounting records such as Journal, General Ledger, Trial Balance and Financial Statements and issue Financial Statement in English version.

-

Preparation tax service for Yearly Corporate Income Tax return (PND.50 form)

- Preparation of secretarial documents consisted of: Application form for Company's Information Submission (Sor.Bor.Chor.3) Form, Shareholders’ List (Bor.Oor.Jor.5) Form.

- We will be applied as chartered accountant (with bachelor degree in Major of Accounting) to Ministry of Commerce (MoC) as accountant of your company.

- To file(submit) to related government consists of: The Revenue Department (RD) and MoC (E-filing).

- Step of AGM, to follow the enforcement of the Civil and Commercial Code sector 1175 regarding the “Sending of Invitation Letter for annual shareholders meeting”, it’s effect to the approval for the financial statement of year ended December 31, 2021 and onward, therefore all company must send the notice (letter) to invite all shareholders for holding of the annual meeting by post with advice of delivery service and must publish in a local news paper, both procedures require to be done at least 7 days before the meeting date (case of extra-ordinary meeting require at least 14 days).

- Furthermore, our accounting service shall be practiced carefully under the Accounting Act of B.E 2000 and also comply with Thai Accounting Standard (TAS) and Taxation rule.

Remark

- Dormant Company means a company without any business activity; most of dormant company has purpose to standby for doing business,

- This fee may be changed during April to May and can provide to limited clients.

- Step of AGM, Company Limited must follow the enforcement of the Civil and Commercial Code sector 1175 regarding the “Sending of Invitation Letter for annual shareholders meeting” which can be done by you, for more information Click Here .

- Whole year services for dormant company; scope and fee; please see Q4 below.

Basic information on documents to be prepared and filed to related government (in Bangkok area)

The Revenue Department at Company’s Area.

- Financial Statement with certified by auditor (CPA Thailand), 1 set.

- Corporate Income Tax return (PND.50 Form)

Deadline: within 150 days from fiscal year of accounting period.

Remark: Currently the submission can be done by 2 options as:

- Filing by hand same as mentioned above.

- Upload via webstie (of Revenue Dept.) for both PND.50 form and scanned pdf.file of Financial Statement.

The Ministry of Commerce (Department of Business Development)

- Financial Statement with certified by auditor, Sor.Bor.Chor.3 Form and Bor.Oor.Jor.5 Form must be uploaded via website of Department of Business Development.

- Deadline: within 1 month from Annual General Meeting (AGM) and AGM must be held within 4 months from fiscal year of accounting period.

Remark: Currently don't allow for submission by hand or post.

Late Submission of Dormant Company : Penalty

At Department of Business Development,

There are 2 kinds of the late submission of financial statement, your company may fall into one of these.

- Annual General Meeting was set in time (4 months from end of the period) but submit late than 1 month, the penalty depends on number of months which will be charged to only Entity (Company Limited) with maximum rate of Baht 12,000.

- Annual General Meeting was set late for 4 months but submitted within 1 month, penalty will be charged to Company in amount of Baht 6,000 and for Director 6,000 for each person.

At Revenue Department

- Penalty will be charged to the company for 2 kinds which consists of: Baht 2,000 for late submission of the company's financial statement and and other Baht 2,000 for late filing of Tax Return (PND.50).

Interesting Topics related to dormant company / shelf company in Thailand

- search existing company/ free

It's free of charge, Panwa can help customer to search the situation of alive or non-alive company if your company didn't submit financial statement or file tax returni. Please feel free, this information is public which allows everyone to check through online database of DBD and will not encourage for legal problem to this dormant company.

- duplicate incorporate documents

There are many kinds of duplication that we can serve from incorporate documents and tax forms, at DBD it can be duplicated immediately and counld get the result within the same day of your order, even tough the original documents are in Thai language, we can provide English translation for you too.

- Dormant company with VAT and without VAT

Dormant VAT company (register VAT) must be filed monthly VAT form (PP.30 Form) every month even tough no transaction of business, penalty will be charged when late of filing. Actually VAT can be applied later when you have fall into one of these 4 situations; 1) company generate income of Baht 1.8 per year, 2) Your Supplier or Customer force you to register, 3) deal business with Government Sector, 4) apply working permit. If your company does not fall into these situations, there is no need to apply VAT so that you can minimize liability and duty regarding VAT operator company.

- VAT's duty and liability for dormant company.

As previous topic, you have to file monthly VAT every month even tough no transaction, in case of fail to file there is a penalty of Baht 500 per month and VAT can be cancelled after 3 years and step of return VAT is too complicated. VAT operator will be monitored by Tax Officer closely and of course they will survey your place to collect the information for the next checking.

CIT is no exception for dormant company. CIT is twice time filing a year which consists of 1) Half-year tax, it's just estimate tax for filing, 2) Yearly tax, the financial statement must be done and audited by auditor and enclose the PND.50 form.

Tax amount and abilities can be decreased when have proper plan through registered capital and VAT registration. At the beginning you can register company with minimum capital and partially paid up of capital and non-VAT registration first then later when operation time come you can increase capital and do VAT registration; these steps just take time only 1 day but you can save tax amount almost Baht 100,000 per year, you can look into Q&A - item Q1 as below.

- Clean up dormant tax and penalty

Long time did notn file tax return or did not submit its financial statement, we can start by providing you with an estimated of all provision costs including penalty and surcharge and timeline, so you can trust on our professional team in this field. Of course we can try the way to reduce the penalty and surcharge (if any), we can finish within a few days or within 1 day too.

- How long can be kept as a dormant.

In Thailand, there is no limit time for keeping company as dormant, as long as your company still submit its financial statement.

- Non-Alive dormant or Defunct company

In case did not submit financial statement for 3 consecutive years, your company may be deleted from the DBD's system to be Non-Alive company (Defunct company). If you intend to reoperate the business or commerce, it can be done by requesting the court to order the Registrar for recovery.

- To recover Non-Alive (Defunct)dormant company to be alive company

If your company become Non-Alive or Defunct Company, due to the financial statement wasn't submitted for 3 consecutive years, please feel free if you intends to reoperate their business or commerce it can be done by requesting the court to order the Registrar for recovering the company name back into the register, in accordance with the article number 1246 (6) of Civil and Commercial Code. We can help you to clean up all matters related to Financial Statement and Tax filing including penalties. Anyway for Court and legal issues, we will recommend a professional trustworthy lawyer to support in this field.

- Dormant company and bank account

There is no requirement to have Bank account for dormant company so you can keep dormant company without bank account as long as you wanta Anyway if already have bank account in financial statement must declare the bank details too.

Many dormant companies hold property for the ownership purpose; this is a simple and applicable way for foriegner to hold property in Thailand but basically business entity that was registered under law must run business for profit, so the dormant must generate income and pay tax in Thailand too.

Same as ordinary company when the business can't survive or don't want to carry on, the company must dissolve and later is liquidate, with this Panwa can help you for all steps and if need we will still help for keeping (stoarage) of all document for the next 5 years and also destroy when complusory time is reached.

- Sale or transfer of dormant company

Normally we have service for transfering of dormant company to other investor or perhaps if we had served for accounting and tax for many years and can trust in financial situation of your dormant we will find investor for you or we can take over your dormant company to be our company too.

- Penalty for dormant company

Same as ordinary company, in case of late submission of financial statement your dormant company must pay for the penalty at DBD and RD. For further detail please visit our website at: https://www.panwagroup.com/latesubmission-fine-penalty.htm

Annual General Meeting was set late for 4 months but submitted within 1 month, penalty will be charged to Company in amount of Baht 6,000 and for Director 6,000 for each person.

- Paid up company for dormant and SBT tax.

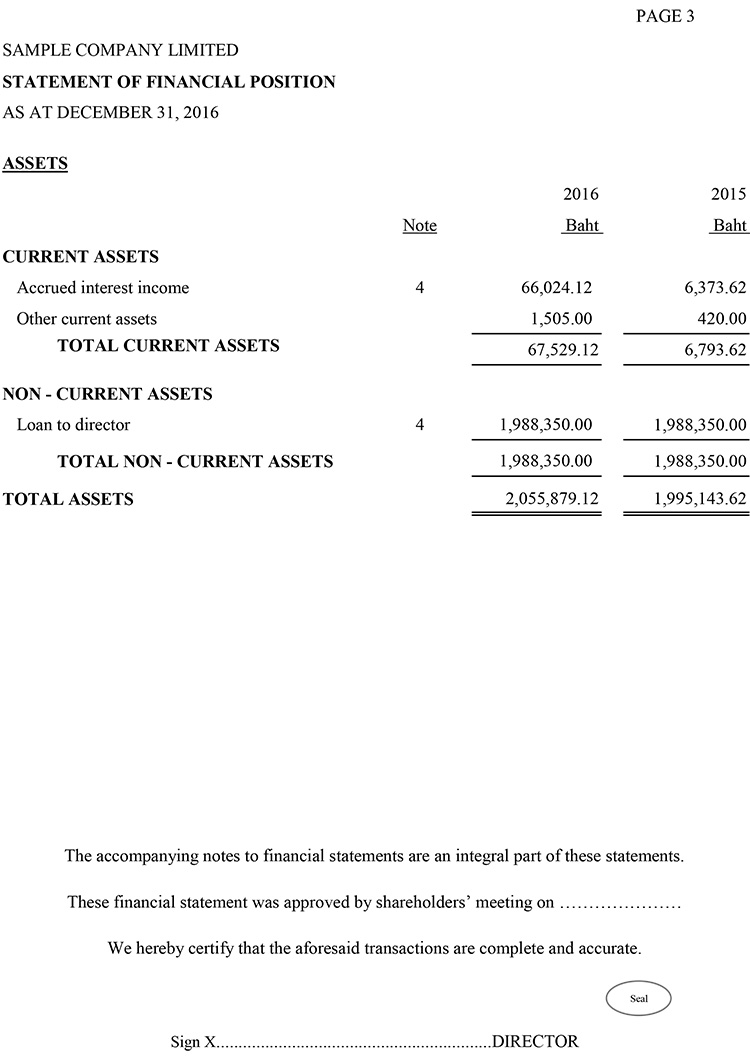

When the paid up capital was declared as fully paid up and did not put the fund into the business or deposit into the company bank account, the rest amount must be recognized as "Loan to director" and interest income must be calculated at 1.5% per annum and when receive its interest income the SBT must impose at rate 3.3% of interest income.

- Plan to register a dormant company

To reduce tax paid amount you should register company with minimum capital and of course you can declare as partially paid up too and also VAT can be registered later whenever you start to operation.

- Is it possible to leave the dormant company without liquidation (closing).

It's impossible by law but someone they still leave the company which they have liability for penalty and most cases the Police will issue "Summon Letter" to director in order to investigate and if still ignore, the Poclice will send your case to the court for further enforcement such as be arrested at Airport when you pass the immigration process.

- Police's Summon Letter for dormant company

If your company did not submit financial statement you may get the Summon Letter and request to meet the Police for investigation; please feel free to contact us, we can be a representative to meet and explain on your behalf. Of course for the amount of penalty it must be paid and proved by official receipt.

Q & A

Q1: What are Government expected tax amount of dormant company I have to take in consideration for one year?

Panwa: Taxation of dormant company base on kind of related tax below;

a. Corporate income tax (CIT), imposed base on “net profit” below is tax rate for year 2019 as below:

Net Profie |

Incentive for SME

Capital not exceeding

Baht 5 million

for year 2019

|

Ordinary company

Capital exceeding

Baht 5 million

for year 2019

|

0 - 300,000 |

0% |

20% |

300,001 - 3,000,000 |

15% |

20% |

Over 3,000,000 |

20% |

20% |

Normally, net profit will be calculated by = Income – Expenditure, for this should concentrate on kind of income as below situation:

- You put capital fund into bank( such as saving account), this kind of income is “Interest from Bank”

- You do not put that capital fund into bank that mean still keep in your personal bank, that fund must be recorded as “Loan to director”, this kind of income is “Interest” form its loan. Applicable interest rate for this borrowing is 4% per annum.

Example; Case study:

Capital is Baht 10 million, Expenditure Baht 20,000 for 1 year period, tax amount will be paid is Baht

(4%10,000,000) – 20,000 = Net profit = 380,000 Baht,

CIT - Tax amount = 20%380,000 = Baht 76,000 per year) , applicable tax rate is 20%

**SBT – Tax amount = 3.3% of 400,000 = Baht 13,200 per year, will be paid when settle interest of loan.

Remark; We advise you avoid a huge of tax amount by 2 ways below:

- 1. Setting up company with capital no exceeding Baht 5 million

In the same case study; tax amount for capital Baht 5 million is

CIT = Baht 4,500 per year.

**SBT = Baht 6,600 per year.

- 2. Setting up company with capital no exceeding Baht 5 million and paid up only 25% of registered capital.

In the same case study; tax amount for capital Baht 5 million with paid up capital 25% is

CIT = Baht 0.00 per year.

**SBT = Baht 1,650 per year.

- 3. We recommends you to set up company with capital of Baht 1 million and paid up only 25% of registered capital.

In the same case study; tax amount for capital Baht 1 million with paid up capital 25% is

CIT = Baht 0.00 per year.

**SBT = Baht 330 per year.

b. Half year tax, except for the first year, but for the second year and onwards will be paid at least 50% of CIT, and can use its tax as credit amount for CIT’s calculation at ending period.

c. Monthly withholding tax, will withhold and be paid within 7th day of the following month. Normally, dormant company no business activity will no withholding tax amount.

d. VAT, there are no requirement for registration of dormant company because of income still not exceeding Baht 1.8 million. VAT registration can be done later when start the business activity.

e. **Special Business Tax (SBT), base on “Interest Income” from “Loan to director” by applicable tax rate is 3.3% per annum.

|

Q2: In case of Dormant Company should a real capital be shown in Balance Sheet? (I mean transfer of cash amount in a bank account in Thailand.)

Panwa: Most of new registered company in Thailand were not real put the capital fund into bank account of company, they only declare on step of registration by certify on documents that the shareholder had put that fund to company account already (likely keep into individual of shareholders’ account or keep on hand of shareholder that mean shareholder or director keep on behalf of the company and waiting for put to company bank account in future without specific time).

Anyway please notice that government concentrate for alien or alien company to carry on business in Thailand for using nominee (illegal), Government require Thai shareholder (nominee) to present their capital fund (individual’s bank statement) in order to prove that Thai Shareholder have ability to do business and be real shareholder (not nominee) by declaring that statement when registration company, if this company fall into 2 situation below

1) Alien hold the share more than 40% up to 50% or,

2) Alien hold the share lower than 40% and be the director. |

Q3: Is there any restriction or delay about starting business activities from the moment of the Dormant Company creation date?

Panwa: No restriction for delay of activity from the registration date of dormant company. Anyway case of registration VAT, Revenue Dept will delete out form their data if no business activity within 1 year that mean you can re-apply again when start business. So I recommend when setting up company no need to apply VAT. |

Q4: What would be your fees for whole year support of dormant company?

Panwa: We offer 2 options for dormant company:

- Whole year services, covering accounting and auditing financial statement, yearly Corporate Income Tax (CIT), Half-year CIT, Monthly withholding tax and VAT.

The fee is Baht 36,000 per year.

- Yearly services, covering accounting and auditing financial statement and Yearly CIT ( not any tax during the period).

The fee is Baht 15,000 (as mentioned on http://www.panwagroup.com/dormantcompany.htm )

*** The above options include providing financial statement in English version.*** |

Q5: Can the company stay in dormant status, until we are ready to start our business? Panwa: Yes, the company can be held status of dormant as long as you want. |

Q6: Are the foreign shareholders eligible for a Non-Immigrant B visa while the company is still in dormant status? Panwa: No, it's not allow for dormant to apply NON B. |

Q7: Can we open a bank account for a dormant company?

Panwa: Yes, the dormant company can open company bank account but the foreign director must having work permit, anyway case of without work permit Panwa can can recommend you to open with a local bank (without require work permit of director) by this you can get saving bank account, current bank account for Thai and Multi-Currency and also you can get TOKEN device for optiain the password for access internet banking from anywhere (outside Thailand). |

Q8: in case the company is dormant do we need to submit a Thai bank account details?

Panwa: We would recommend you that if in case your company still dormant, so no need to open a bank account right now, due to if in case you already open bank account even though your company is dormant or active company, you still have the responsibility to declare the bank statement updated until currently to the auditor as well. |

Q9: We have a dormant (shelf) company in Phuket but the tax documents have not been filed for 7 years since incorporation. There had been no activities. I would like to correct this situation. Is there any way to solve this without getting into legal trouble?

Panwa: Due to your company had registered many years ago, we have to check whether the company is still alive or existing and after that we can provide you an estimate OF the cost, penalty and timeline. Anyway, the company may not be alive or become Defunct company if did not submit the balance sheets and income statements since the current year and also retroactive for 3 consecutive years. So if found not alive anymore, you do not need to do anything.

Q10: I am concerned that if you start to search this dormant company information this may trigger unwanted attention from the tax department. I am afraid of legal consequences and do not wish to encourage legal problems to this dormant company.

Panwa: We will search or check on the government website (DBD); it is open for public information which anyone can search/check, we will not contact with the government officer. Moreover, the reason that we would kindly like to search or check first is that we would like to see if this company is still existing or the government already cancelled (Defunct Company or unoccupied company) on their system already.

Q11: I would like to keep the company alive but dormant, our property is registered under the company name so if it's not alive or become Defunct company, please advise the solution to recover back to reoperate.

Panwa: The following steps to recover the company name back into the register ARE:

- Defunct or Unoccupied company, that intends to re-operate their business or commerce must request the court to order the Registrar for recovering the company name back into the register in accordance with the article number 1246 (6) of Civil and Commercial Code.

- Recovering method is Company, Shareholders or any creditor, must retain the lawyer to file a request to the court. Then court would order the Registrar to recover the company name back into the register. So, total length of period since requesting until the court order the Registrar to enroll back into the register is approximately 2 – 4 months.

- After the court order the Registrar to recover the company name back into the register, the requestor may make a copy of court order with warranty by court officer. Then you need to prepare the notice to inform the Registrar for recovering the company name back into the register in accordance with the court order and also attached it. (Copy of court order with accurate warranty by court officer).

- After the Registrar receives the court order, he will execute his command to RECOVER the company name back into the register and also rectify the detailed information in the memorandum of association. Then he will bring this order to enroll the company name back into the register to announce in the Government Gazette.

After the Company (the company name in the register) has been recovered, it will be considered as the Company still occupied without crossing the company name out of the register in accordance with the article number 1246 (6) of Civil and Commercial Code. So, (AS TO-delete) the company will have the same status as the juristic person, WILL still have the right, duty and responsibility to comply with the law.

Therefore, the company has liability to submit the financial statement for the past years and also file all kinds of tax return and also its penalty and surcharge (if any).

Further information, please visit our website at: https://www.panwagroup.com/Defunctcompany.htm

|

| |

|