American can setting up company under Treaty of Amity (between Thailand and USA)

A company who wish to apply for registration under “Treaty of Amity” must comply with the following procedures:

STEP 1. Company Registration as an Alien Company

The Government officer recognizes a foreign company and permits the alien (American Citnzen or Entity) to have 100% ownership but not yet running business until finish STEP 3.

STEP 2. Application for Certificate at the US Embassy in Thailand

STEP 3. Application for Approval of the Director of the Ministry of Commerce.

There are 3 conditions that the company must comply with

3.1 US citizen shareholder must hold shares more than 50% up to 100%

3.2 Director(s) can be Thai or U but if need the third contry director, US director or Thai directorm must more than the third country.

3.3 For a single company director, it can be Thai nationality or US citizen but in case that there will be more than 2 directors, US directors must be more than Thai directors.

The above information states that the USA citizens can hold the 100% ownership of the company and also entitled to run business in Thailand.

Treaty License Regristration in Thailand - treaty or obligation under section 11 of the Foreign Business Act, B.E. 2542 (1999)

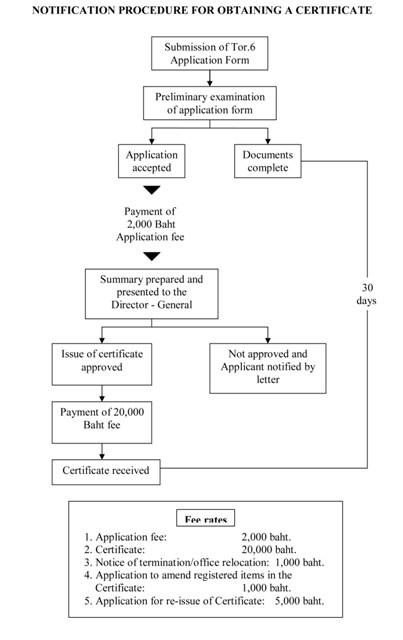

Procdures and Timeline

Government Fee rates

1. Application fee: 2,000 baht.

2. Certificate: 20,000 baht.

3. Notice of termination/office relocation: 1,000 baht.

4. Application to amend registered items in the

Certificate: 1,000 baht.

5. Application for re-issue of Certificate: 5,000 baht.

Application documents:

- A declaration of details of the type of business for which a certificate application is made.

-

A letter from an embassy of a country which is a party to a treaty concluded with Thailand certifying the nationality of the applicant giving notice to exercise rights under the treaty or a letter from an embassy which has a binding obligation with Thailand certifying the nationality of the applicant giving notice to exercise rights pursuant to the obligation.

- A map indicating the approximate location of the place of business operation in Thailand.

- A power of attorney in the case where another person has been authorized to act on the applicant’s behalf.

- Other evidence or documents (if any).

- In the case of a natural person, the following documents must also be submitted:

- a copy of a passport or identification document for foreigners;

- a copy of the house register, a certificate of residence in the Kingdom or evidence of permission to enter the Kingdom for a temporary stay under the law on immigration.

- In the case of a juristic person registered in Thailand, the following documents must also be submitted:

-

a copy of a certificate or evidence of juristic person status containing particulars of the name, capital, objects, place of business, list of directors and authorized signatories of the juristic person;

-

a declaration of the proportion of shareholdings between Thai persons and foreigners and the number of shares and the class or kind of shares held by foreigners.

-

In the case where the majority shareholder or partner of the person making the notification is a juristic person, the same evidence or documents as required from a juristic person not registered in Thailand under 8.1 and 8.2 above shall also be submitted for the shareholder or partner as the case may be.

- In the case of a juristic person not registered in Thailand, the following document must also be submitted:

-

A copy of a certificate or evidence of juristic person status containing particulars of the name, capital, objects, place of business, list of directors and signatories who are authorized to bind the juristic person and the name and nationality list of shareholders or details of partners; in the case where documents showing the name and nationality list of shareholders or details of partners cannot be submitted, a document which shows that a person having the nationality of a country which is a party to the treaty or which has a binding obligation with Thailand holds or invested the majority of shares or money in such juristic person shall be submitted.

-

In the case where the majority shareholder or partner of the person making the notification is a juristic person, a copy of a certificate or evidence of juristic person status of such majority shareholder or partner must also be submitted until the last majority shareholder or partner in order to show that such juristic person who is the majority shareholder or partner of the person making the notification has nationals of a party to a treaty or of a country having a binding obligation with Thailand who hold or invested the majority of shares or money in the juristic person.

-

A letter of appointment of a representative issued by the authorized signatory as appointer of a representative in charge of the business operations in Thailand on behalf of the juristic person.

-

A copy of the appointed representative’s passport, identification document for foreigners or identification card.

-

A copy of the appointed representative’s house register, a certificate of residence in the Kingdom or evidence of permission to enter the Kingdom for a temporary stay under the law on immigration

Qualifications of an applicant for a certificate of business operation under a treaty or obligation:

- A natural person.

- A juristic person of the following composition:

(1) a juristic person established under Thai laws or the laws of a country which

is a party to a treaty or has a binding obligation with Thailand;

(2) the majority of the juristic person’s capital is held by nationals of a country

which is a party to a treaty or has a binding obligation with Thailand;

(3) more than half of the managing directors must be nationals of a country

which is a party to a treaty or has a binding obligation with Thailand

and/or Thai national

(4) if a managing director has been given the authority to sign on behalf of the

company, such managing director must not be a national of a third

country;

(5) if several managing directors have been given the authority to sign on

behalf of the company, the majority of such managing directors must not

be nationals of a third country.

Place of giving notice to apply for a certificate:

- In Bangkok, notice may be given to the Department of Business Development, Ministry of Commerce.

- In other provinces, notice may be given to the Provincial Office of Business Development.

Businesses reserved by treaty (only Thai-American Treaty 1968):

- Communications.

- Transport.

- Fiduciary functions

- Banking involving depository functions

- The exploitation of land, or other natural resources

- Domestic trade in indigenous agricultural products

Warning:

- The applicant must completely fill in the application form in print, which must also be signed by the applicant or by an appointee in the case where another person was authorized by a power of attorney to act on his/her behalf.

- In the case where a power of attorney was executed in a foreign country, such power of attorney must be notarized by an official or by a person who has been prescribed with the powers of notarization by the laws of such country, or by an authorized official of the Royal Thai Embassy or Royal Thai Consulate stationed in such country at a time not exceeding six months prior to the date of submission of application.

- In the case where the power of attorney was executed in Thailand and the appointer does not have residence in Thailand. A copy or photocopy of the passport or certificate of temporary residence, or other evidence showing that at the time of the power of attorney such person had truly entered into Thailand, must be submitted.

- In the case where the evidence or documents in support of the application have been signed in a foreign country, the applicant must provide for the certification of such signatures as required in (2).

- If the evidence or documents submitted in support of the application are in a foreign language, their translations in Thai must be provided. The applicant and the translator must affix their signatures to certify the correctness of the translations.

- The applicant must certify the correctness of copies or photocopies of evidence or documents submitted in support of the application.

Download : Treaty of Amity

Service Fee: Our service fee depend on client request, which normally seperate to 2 steps as below fe:

- Setting up company a private company with Ministry of Commerce

Scope of services covering:

- Covering company registration,, Application for Tax ID. Number and VAT.

- Do not cover; Company Share Certificate, Share Certificate Book.

Timeline: Case all signatory promoters, shareholders, witness, director standby to sign documents and registration form in Thailand, the step of registration will be finished within 1 week.

SERVICE FEE: is Baht 17,000. (up date fee at: http://www.panwagroup.com/setupcompanythailand.htm)

- Apply Treaty of Amity (between Thailand and US)

Scope of services covering:

- Contact to US embassy (Commercial Department) for request for certification under the Treaty of Amity, Embassy charge for US$ 80.

- To apply the certificate of permission with Ministry of Commerce, Government fee for Baht 22,000

Timeline:

- At US Embassy for 5 days for approval and obtain the certificate.

- At Ministry of Commerce for 15 days for approval and obtain the certificate.

SERVICE FEE; is Baht 35,000. (in month of Jan to May the fee will be increased)

Q & A |